32+ can 3 person apply for mortgage

6 steps to applying for a mortgage. Web Can three people be on a mortgage.

German Mortgages Basic Requirements For Expats In Germany

Web Current guidelines for most mortgage lenders dictate that your debt to income must be 43 or lower to obtain a Qualified Mortgage a specific category of mortgage that is consumer-friendly and easier to obtain for most people.

. Web On a joint mortgage all borrowers credit scores matter. Yes you can have 3 people on one mortgage. Web This maximum mortgage calculator collects these important variables and determines the maximum monthly housing payment and the resulting mortgage amount.

Web Can Three People Be On A Mortgage. Depending on the lender you may be able to apply in person by phone or online. Remember that everyone on the loan also has to be able to qualify for it to be approved and some lenders may see a big group of names as a potential risk.

In most states you just have to be 18 or older. Most instances of co-borrowing involve only two parties. Other situations where two or more people apply for a.

Know basic mortgage loan requirements. Can 3 individuals buy a house together. Fill out a mortgage application.

Web Yes 3 people can be on a mortgage- but it can be a little tricky. Web Getting a joint mortgage with 3 applicants is certainly possible but there are some considerations you may have to take into account. There is no legal limit to how many people can be on a mortgage but your lender may have restrictions in place.

Depending on the loan type and the lender you can have three or more borrowers on a mortgage loan. Depending if they occupy the property or are non occupant co-borrowers it makes a difference- bring this up first when you apply. But you dont have to be married to apply for a joint mortgage.

Web When two people apply for a mortgage together the lender typically considers the credit rating and history of the person with the highest income in deciding whether to issue the loan and what the terms will be. You can get a three-person mortgage but some lenders will only consider your application if they are blood relatives. What is the process of getting home loan if I have an existing personal loan.

Expect to qualify with the lowest credit score of the 3. Gather your financial paperwork. Your lender uses only one of your three scores Mortgage lenders rely heavily on your FICO credit score to determine whether to lend you money.

Click here to apply for. There is no legal limit to how many people can be on a mortgage but your lender may have restrictions in place. For example say your credit scores from the three credit bureaus are 723 716.

Web Youll need to select a lender and complete an application. Web Can you have 3 people on a mortgage. Choose a lender and commit.

But three and even four people can purchase a property collectively and many mortgage lenders allow for this arrangement. Web Can you have 3 borrowers on a mortgage. In some cases a blended score may be.

Remember that everyone on the loan also has to be able to qualify for it to be approved and some lenders may see a big group of names as a potential risk. Web Yes its possible to add a third person to your existing mortgage in the right circumstances. With that it may be easier to qualify for the loan.

Lenders determine whats called the lower middle score and usually look at each applicants middle score. Web Say you applied for a mortgage and you and your partner lacked the debt-to-income ratio necessary to make the monthly payments for the house you want despite having strong credit scores. Web Certainly there are high street lenders that will offer you a mortgage in the name of 3 people.

If your current lender allows you to add an extra name to the deeds you will usually have to pay fees associated with changing the contract between you and the lender. The co-borrowers can pool their resources to meet the lenders requirements. Getting an agreement in place before getting into a joint mortgge will avoid so many issues that tend to.

Partners often apply with a joint mortgage to get access to better mortgage rates and terms. Web A joint mortgage means you and your partner or up to three partners apply for the mortgage together. Web Mortgages with 3 applicants.

Other lenders will allow a multiple-applicant mortgage to be given to friends and family but they might not allow all three applicants actual income to be included in the mortgage calculator. Review your Loan Estimates. There are other types of mortgages that have more flexible guidelines.

All lenders require you to provide information about yourself and anyone else such as a spouse or partner who will be listed as a co-borrower on the mortgage. Web Theres no legal limit as to how many names can be on a single home loan but getting a bank or mortgage lender to accept a loan with multiple borrowers might be challenging. Web Can 3 People Buy A House Together.

You may be able to have up to five borrowers on a conventional loan and government-backed loan programs do not stipulate a maximum number of borrowers. Even if people outside your family are allowed on the mortgage certain lenders will not permit the use of everyones income during the affordability assessment. Web Just one spouse or partner can apply for the mortgage.

What you might lose is some flexibility of the choice of mortgage for example some current account mortgages stipulate only two people on the mortgage but if you are looking to only have it for a short period this probably doesnt matter. Web So it makes sense for both names to go on the home loan application. Web Prepare to submit a mortgage application.

Web You can get a three-person mortgage but a few lenders only consider a joint mortgage of more than two people if the applicants are all related. Lenders collect credit and financial information including credit history current debt and income. Web Although many lenders offer online options to make the mortgage application process easier following these six steps to apply for a home loan may save you time and potential delays in the loan process.

Applying jointly can even help your eligibility status in.

Ipads Inclusive Technology

32 Simple Hints Someone Is Financially Stable How You Can Be Too Money Bliss

32 Rs 10000 To 20000 Rooms For Rent In Choolaimedu Chennai

List Of Top Home Loan Providers In Hospet Best Housing Loans Online Justdial

Business Succession Planning And Exit Strategies For The Closely Held

Steam Workshop Avocados

How Many Mortgages Can You Have Assurance Financial

Get Best Loan Offer At Lowest Interest Rate In Pune India

List Of Top Home Loan Providers In Shoe Market Best Housing Loans Online Justdial

How Many Mortgages Can You Have Assurance Financial

Mortgages For 3 Or 4 People On An Application

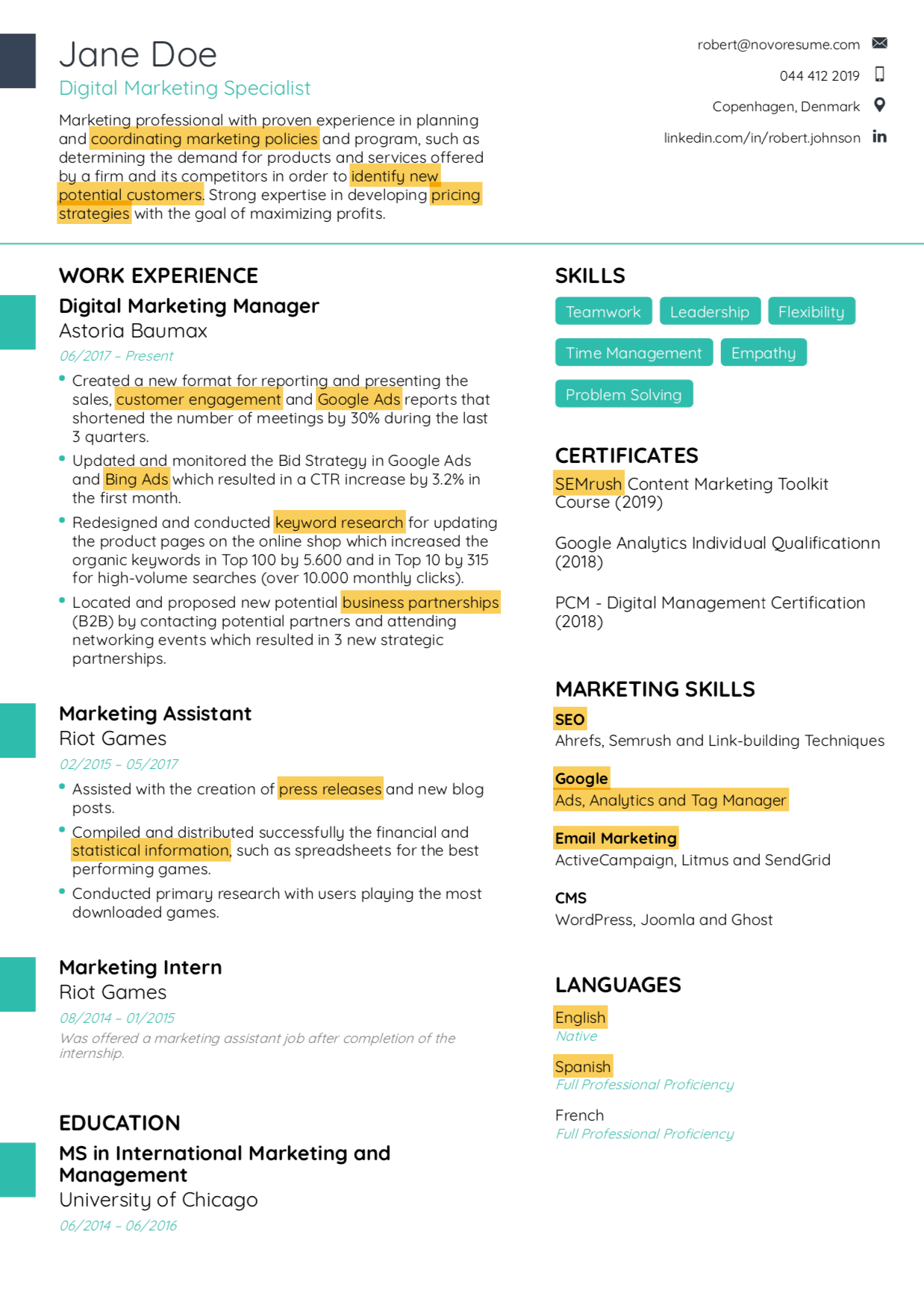

Use Resume Keywords To Land The Job 880 Keywords

Papers Past Parliamentary Papers Appendix To The Journals Of The House Of Representatives 1879 Session Ii Friendly Societies Second Annual Report By The

Pdf Sovereign Bonds And The Does Regime Type Affect Credit Rating Agency Ratings In The Developing World Glen Biglaiser Academia Edu

32 Hour Workweek Act Just Endorsed By 100 Members Of The House Of Representatives R Futurology

11 Approval Letter Templates Pdf Doc Apple Pages Google Docs

Suchergebnis Auf Amazon De Fur Motorwerkzeuge Zubehor 4 Sterne Mehr Motorwerkzeuge Zubehor Werkzeug Auto Motorrad